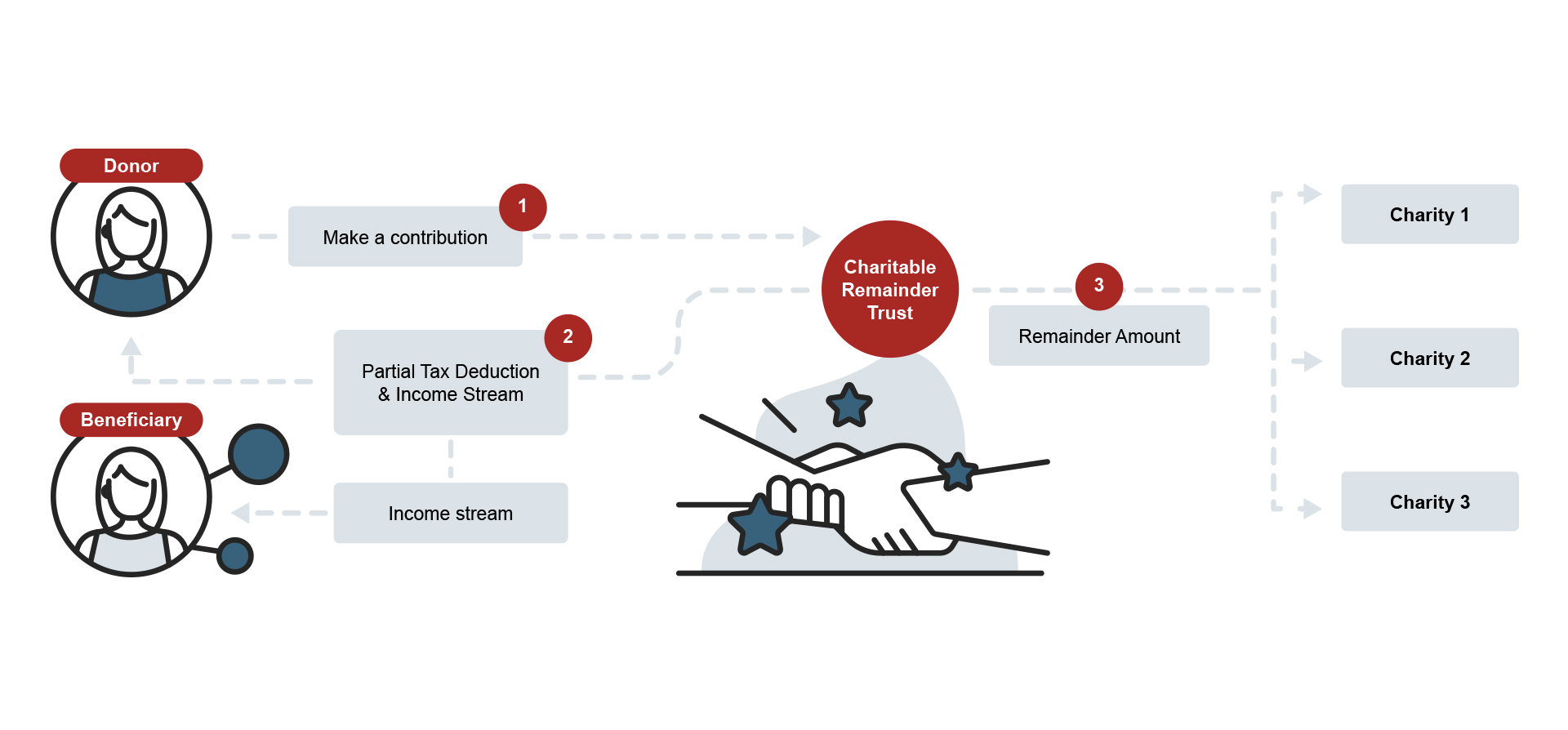

Charitable Remainder Trust

Make a gift now, receive immediate tax benefits, and continue to receive the income for as long as you, or you and your spouse live, or for a specified number of years.

With a charitable remainder trust, income from the trust is paid to a beneficiary until the trust terminates, which may be after a specified term of years (but no more than 20) or after one or more lifetimes. When the trust ends, the assets remaining in the trust (the “remainder”) are distributed to Golf Canada Foundation as stated in your trust document.

Since charitable remainder trusts are irrevocable gifts, the donor is usually entitled to a donation receipt when the trust is created. The receipt amount is based on the present value of the remainder interest (usually 20 – 60% of the value of the property), determined by the fair market value of the assets, interest rates, the donor’s age, and the specifics or duration of the trust.

How to establish a charitable remainder trust:

A charitable remainder trust can be funded with cash, securities or real estate. Assets are placed into a trust to be managed by a trustee, such as a financial institution, yourself, a lawyer or other individual.

In the trust document, name yourself or others as the beneficiary of the interest income and name “The Governing Council of the Golf Canada Foundation” (Charitable Registration #126408129RR0001) as the remainder beneficiary.

Advantages of giving charitable remainder trusts

- Charitable remainder trusts will provide you with the satisfaction of making a sizeable gift to Golf Canada Foundation.

- You will continue to receive the income generated by the capital for as long as you, or you and your spouse live, or for a specified number of years.

- You will receive a donation receipt now that you can use to offset current tax liabilities.

- No matter how much taxable gain is attributable to the charitable remainder of your trust, the tax credit resulting from your donation receipt will always exceed the tax on the gain.

- A charitable remainder trust removes the property from your estate, guaranteeing your privacy and reducing probate and other estate fees.

- You will be free from management responsibility of the asset.

Who benefits from a charitable remainder trust gift

- From a tax perspective, charitable remainder trusts are usually of interest to upper-income donors who are age 70 and older.

- The donor is typically in a high marginal tax bracket, has a philanthropic intent and the ability to donate some of their assets.

- Typically, a donor should be in a position to establish a trust worth at least $100,000 initially or after a few contributions, as there will be professional fees for set-up and annual administration.

Create your legacy

To ensure that your particular needs are met and that your wishes are honoured, you should consult your financial advisors.

Please contact Golf Canada Foundation to let us know about your intentions. Not only can we assist you in making sure things move along smoothly, we can discuss how you would like the proceeds from your gift be put to use. It is also important for us to know whether you wish to be recognized for your contribution or prefer to remain anonymous.

If you have made arrangements to make a planned gift to Golf Canada Foundation, we request that you send us a completed Statement of Intent (PDF) so that we may ensure proper administration of your gift.

Contact

Erika Minkhorst – Director Development, Trustee Program

Golf Canada Foundation

1-1333 Dorval Dr, Oakville, ON L6M 4X7

Toll-free: 1-800-263-0009, 905.849.9700 x265

Email: eminkhorst@golfcanada.ca